A recurring theme in my consumer-focused story is simple equals better. The less you confuse customers, the more likely they'll single out a product or brand and retain a sense of its importance and utility in their everyday lives. For most items (not luxury or splurges, though), this is the main goal of marketing, branding, and consumer loyalty pitches. But sometimes it seems like confusion is the main goal of marketing: distract your opponent with the most noise and they'll acquiesce, pulling out their credit cards in the process.

According to Chain Leader magazine, a national survey conducted by the Shelton Group suggests that while the majority of Americans are interested in buying more green products, they are confused and lack information about how to choose among the array of possibilities. Indeed, Shelton Group's results have been presented as demonstrating that people would sooner buy natural rather than organic because they're confused about what organic means. Of course, the irony of this finding is that "organic" in the food category now carries a USDA certification and label, whereas "natural" has been so watered down by overuse in a variety of inconsistent ways, those that they surveyed tended to gravitate towards "natural."

Although Shelton Group generally has a sophisticated approach to sustainability (see their blog, for example), in this survey, they were perhaps misguidedly attempting to measure people's knowledge of green products, with organic and natural being presented as components of green. But even certified treehuggers will tell you that green is a variable and difficult concept to grasp in the first place -- and in fact, is already the focus of derision by those who can see the marketing handwriting on the wall, greenwashing their way into consumer's coffee cups, kitchens, and recyclable shopping bags. In an interesting twist, it seems that sometimes a government seal of approval is not enough -- in fact, it turns out possibly to confuse the matter more -- to make consumers step up to the cash register with certainty about what's in their cart. One thing is for sure: companies need to tread through the green fields lightly, accepting the fact that green is not as obvious as you'd think.

Tuesday, September 08, 2009

All Lost in the Supermarket, Take 2: What's Green Anyway?

Posted by

Annie

at

10:02 AM

0

comments

![]()

Labels: green, natural foods, organics, sustainable

Thursday, August 13, 2009

Twenty Five Kinds of Super Glue

I kid you not.

I kid you not.

"I have found myself standing in front of the Pantene display, trying to figure out if I need the product for dry hair with frizz or dry hair with split ends," said Mr. Steinhafel, a thick-haired 54-year-old. A typical Target store has 88 kinds of Pantene shampoo, conditioner and styling products. A Target spokeswoman said the chain has "slightly reduced" its hair-care offerings this year.

The more-is-better approach can backfire, warns Mark Lepper, the chairman of Stanford University's psychology department, who studies how variety affects the odds that people actually buy. Mr. Lepper set up a table with 30 jars of jam and gave shoppers who stopped for a sample a discount coupon for their next jam purchase. He also had a table with six jams. He counted the coupons to see which group was more likely to buy. Of the shoppers who faced 30 choices, only 3% actually bought jam; of the shoppers who had six choices, 30% purchased jam.The study, like many others, concludes that too much choice was not a good thing. People also feel bad when choosing from a broad selection because they second-guess their pick and worry they have made a poor selection, his follow-up studies revealed.

I'm still stuck on the eighty eight kinds of Pantene shampoo. Seriously, I normally try to curb my consumer rant voice when I'm exploring the rationale behind retail, but that's just mind-bogglingly ridiculous. There simply aren't eighty eight different kinds of hair problems that warrant their own product. Indeed, P&G has pulled back, repackaged, and cut some of the varieties in order to address less-than-desired sales.

I'm still stuck on the eighty eight kinds of Pantene shampoo. Seriously, I normally try to curb my consumer rant voice when I'm exploring the rationale behind retail, but that's just mind-bogglingly ridiculous. There simply aren't eighty eight different kinds of hair problems that warrant their own product. Indeed, P&G has pulled back, repackaged, and cut some of the varieties in order to address less-than-desired sales.

Posted by

Annie

at

1:14 PM

1 comments

![]()

Labels: brand extension, brand retraction, consumer preferences, retail logic

Monday, August 10, 2009

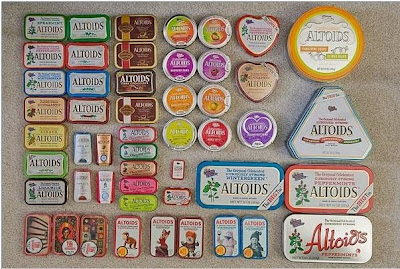

Of Mints and Markers: Curiously Strong and Sharp

Some products are things we never knew we needed. Smart marketing takes advantage of the unique ways that people value everyday items.

Some products are things we never knew we needed. Smart marketing takes advantage of the unique ways that people value everyday items.

Referencing their most recent summer campaign, Sally Grimes, global vice president of marketing for Sharpie, told Marketing Daily: " We're starting now because we think Sharpie is about much more than a school supply. It's a tool for self-expression not necessarily tied to any particular season."

Referencing their most recent summer campaign, Sally Grimes, global vice president of marketing for Sharpie, told Marketing Daily: " We're starting now because we think Sharpie is about much more than a school supply. It's a tool for self-expression not necessarily tied to any particular season."

Posted by

Annie

at

1:17 PM

1 comments

![]()

Labels: art and advertising, cause marketing, DIY, markers, mints

Monday, August 03, 2009

Credible Claims and Big Savings

Credibility always counts in marketing, but even more these days when consumers are questioning the trustworthiness of their banks, the safety of their food, and the value of the products they are purchasing as funds have tightened up. Interestingly, polls now show that the same people concerned about safety issues in the food system are also exhibiting greater trust in small or local banks. Retail marketing campaigns that aim to capture the frugal consumer are extremely vulnerable to skepticism in the age of internet activism, advice, and response. Setting aside their big blunder with free chicken, Oprah, and coupons, KFC got into some hot water with consumers when a recent ad challenged a family to create a meal from the grocery store for as little as it cost for one of their seven piece dinners (roughly $10). Tons of bloggers and ordinary folks took the challenge and, armed with Joy of Cooking, common sense, and price spreadsheets, "brought the colonel down."

While acknowledging that all price-matching programs have terms and limitations that may not reasonably be expected to be disclosed in a TV spot, the NAD recommended that Wal-Mart "make its disclosures substantially more clear and conspicuous in its printed and broadcast advertising and on its in-store signage." It also recommended that it ditch the "$700 annual savings" claim entirely. "The use of the phrase "on average" does not temper the overriding message that the viewer -- wherever located -- can expect to obtain these savings," the watchdog group says in its release.

Posted by

Annie

at

10:01 AM

1 comments

![]()

Labels: credibility, KFC, marketing, Wal-Mart

Thursday, July 16, 2009

Organic Adjustments: Cultivating the Consumer

Everybody adjusts to economic change in different ways. Public advocates from Oprah and Mommy Bloggers to Kraft and your favorite insurance company has suggestions about what you can do to make it through tough times, whether you're just being cautious or facing serious financial cutbacks. One thing that hasn't changed with the economy is the glut of willing advice-givers who'd like to take the place of your local community sage, your grandmother, your priest or rabbi, or your best friend. The diffusions of a global marketplace bring all sorts of goodies to your doorstep (getting tired of pomegranate juice? Get ready for at least a few of the 1,000 varieties of Indian mangoes coming to the American market). At the same time, we're not sure who to trust anymore -- especially when it comes to the food system. Indeed, the growing green and organic movements have always been partly motivated by failures of government and industry safety protocols -- and that certainly hasn't changed. But how to hold onto that steady market and establish your company as a positive force?

Everybody adjusts to economic change in different ways. Public advocates from Oprah and Mommy Bloggers to Kraft and your favorite insurance company has suggestions about what you can do to make it through tough times, whether you're just being cautious or facing serious financial cutbacks. One thing that hasn't changed with the economy is the glut of willing advice-givers who'd like to take the place of your local community sage, your grandmother, your priest or rabbi, or your best friend. The diffusions of a global marketplace bring all sorts of goodies to your doorstep (getting tired of pomegranate juice? Get ready for at least a few of the 1,000 varieties of Indian mangoes coming to the American market). At the same time, we're not sure who to trust anymore -- especially when it comes to the food system. Indeed, the growing green and organic movements have always been partly motivated by failures of government and industry safety protocols -- and that certainly hasn't changed. But how to hold onto that steady market and establish your company as a positive force?

- Blog, blog, blog: it seems like a truism that women in particular are drawn to blogs and other social media as sources of information. There's no shortage of advice about organics on these sites and many of them incorporate a message about the true costs of non-organic foods, the budget-saving aspects of cooking with natural foods (despite, of course, the reality that organics are still priced premium), and savvy shopping and cooking techniques (which, in fact, are the best way to "work around" the pricing issue). The Big Green Purse and other mom-friendly websites do eco-friendly product evaluations in a chatty but knowledgeable style.

- Corporate websites that give good basic information along with marketing promotions. Stonyfield Farms Yogurt is my favorite example of this: people go to their site for facts as much as they go for the coupons (I'm not the only one, I discovered!). Other websites are repositories of information, especially if the product is marketed entirely on its organic pedigree. Swanson vitamins sells only through a catalogue and online, but has weekly health research articles, an informational blog, and indexical information about supplements and natural ingredients.

- Your friendly neighborhood university or academic publication. The internet has opened up all sorts of information to the public access. People are as likely to check out first hand sources as they are to repeat what they heard on the news. Institute websites, press releases, public lectures, and even alumni publications are hot to capture the knowledge market. And even better if your audience is women: Vassar's Alumni magazine had a recent feature on avoiding unseen toxins; Smith and Mt Holyoke have featured "food issues" of their quarterly publications.

- In-store media is a successful, but often under (or badly) utilized source of information. Supermarkets are a mixed bag for consumers, often providing a glut of advertisements and enticements without critical distinction, but they do offer the most direct place where consumers make decisions. In-store media -- especially cooking demos and tailored local content -- still stands somewhat apart from endless coupons, circulars, and print media that swallow the shopper.

Posted by

Annie

at

2:14 PM

0

comments

![]()

Labels: blogs, consumer knowledge, natural foods, organics

Wednesday, July 01, 2009

Learning to Live with Frugality

We’re far enough along in the economic downturn for there to be a glut of ad campaigns aimed at the thrifty consumer. From Wal-Mart and Target to Virgin Mobile and Kraft, creative copy is being funneled into the contradictory practice of getting conserving consumers to, well, consume. Most approach it as a "trust me, we’ve got bargains" line of reasoning. Some, like the recent "don’t feed the pig" campaign for tourism in Finland, have a screw-the-recession ethos that may be appealing but ultimately no more or less effective (because, after all, if you haven’t got it to spend, you haven’t got it). Although very few companies follow it, the basic principle during downturns is that steady or increased advertising (no matter what kind) almost always works.

We’re far enough along in the economic downturn for there to be a glut of ad campaigns aimed at the thrifty consumer. From Wal-Mart and Target to Virgin Mobile and Kraft, creative copy is being funneled into the contradictory practice of getting conserving consumers to, well, consume. Most approach it as a "trust me, we’ve got bargains" line of reasoning. Some, like the recent "don’t feed the pig" campaign for tourism in Finland, have a screw-the-recession ethos that may be appealing but ultimately no more or less effective (because, after all, if you haven’t got it to spend, you haven’t got it). Although very few companies follow it, the basic principle during downturns is that steady or increased advertising (no matter what kind) almost always works.

Since as early as last fall, market analysts and consumer behavior specialists have been tearing up the population segments, scrutinizing up and down to make prognostications (is "the new frugality" temporary? Widespread? A long term trend?) designed to keep companies afloat and ahead of the game. As Tessa Wegert of ClickZ put it,

According to a survey conducted by Harris Interactive and commissioned by online coupon site RetailMeNot, consumers are likely to cut their budgets during an economic recession but will continue to spend if provided with discounts. They're also just as likely to look to the Web for deals as they are to stores. In response, consumer marketers are focusing their most recent ad campaigns not just on the bargains they're able to offer but also on the economic value they can deliver at a time when the country's acutely aware of what it's spending and where. Ads that take a decidedly cash-conscious spin are cropping up on television, in print, and of course, online. While a drop in sales is certainly cause for worry for many consumer good producers, a quick glance at the history of our culture says we’re a long way away from the death of consumerism.

Posted by

Annie

at

10:03 AM

0

comments

![]()

Labels: frugality, marketing recession

Wednesday, June 24, 2009

Supporting Sustainable CPG

A few weeks back, the Food Marketing Institute released findings about changes in consumer shopping patterns. While the main thrust of the study was a breakdown of the stages that shoppers go through when coping with the widening reach of the recession, it might be equally interesting to focus on what has remained consistent --and its implications for retail organization and marketing.

According to FMI's study, shoppers are still highly concerned with finding more nutrition and health information, in-store pharmacists to provide health advice, easy-to-make recipes, ideas for cooking a meal for $10 or less, and convenient placement in the store for dinner items such as pasta, sauce, bread, meat and salad. Sustainability is also still a strong consideration. According to the report: Food shoppers continue to show strong support for locally grown products, with 72% of shoppers saying they purchase locally grown products on a regular basis, driven by a desire for freshness (82%), the desire to support the local economy, (75%) and taste (58 %).

Someone must be getting it right because CPG was one of the few growth areas in the last six months. Support of core brands has been one key strategy. For example, ConAgra has increased its advertising spend to support the Healthy Choice brand, relaunched and designed to leverage consumers' increasing desire for healthier, easy-to-prepare foods. While marketing has been one key factor in this, some research is suggesting that CPG growth is also related to a shift in the way the company -- and its employees -- interacts with customers and its retail clients. One argument is that its front-of-the-house sales force has to be more diverse with skills related to customer service, strategic merchandising insights, and traditional sales approaches:

Critical is finding ways to incorporate those consumer concerns directly into the basic approach of any CPG company. So how do large wholesalers with an emphasis on prepared foods take advantage of the consumer's desire for the local and the sustainable?

Posted by

Annie

at

6:37 AM

1 comments

![]()

Labels: CPG, diversification, FMI, local suppliers, qualitative data, sustainability

Friday, May 29, 2009

Irrationality: we got it, but can you capitalize on it?

William Cusick, who runs VOX, a customer experience consulting firm, has gained some notoriety for proclaiming that "All customers are irrational" (appropriately used as the title of his forthcoming book) but that marketers can still use behavioral psychology to strategize sales and profitability. Irrational, to Cusick, is mitigated by encouraging consumer loyalty at every step of the branding process.

Cusick does a great job of pointing out all the ridiculous ways that corporations organize their promotions and sales to attract new customers while ignoring the better revenue possibilities that come from more attention to your current clients. Just think of your mobile phone service contract or your internet service and you get the idea: While Cusick emphasizes findings from brain research (which feels like overcompensation -- to dress up good insights with the unassailable imprint of Science) – his real skill is at breaking down the sales experience from the consumer’s perspective and mirroring that back at retailers. I particularly like Cusick’s Twelve Steps to Improve Customer Experience, which, as he points out, are incredibly easy to implement and rely on rather inexpensive methods (such as qualitative observation, adding more trained personnel rather than technology, and mapping customer experiences).

Posted by

Annie

at

12:15 PM

0

comments

![]()

Wednesday, May 27, 2009

Checking in on the Gap: Old Navy Riding the Waves

Not surprisingly, the Gap reports drops in retail sales over this last quarter. While the company and its three stores – Old Navy, Banana Republic, and the Gap – have been struggling to return to earlier gangbuster popularity. Expansion, rapid merchandise turnover, and shifts to the brand identities were not sorted out and established strongly before the recession really started to take a bite out of everyone’s clothing budget.

In the past I’ve singled out Old Navy as an example of a concept gone awry, a good idea that went too far in the wrong direction. The last few clothing lines have not included enough interesting and basic pieces to attract the right segment of customers and, unlike more teen-upscale lines like Abercrombie or Aerie, wearing a shirt with the brand name across it isn’t signaling anything status-wise. The turn-around for styles was so fast you could buy a sweater one day and find it in the reduced aisle next week. And of course, the one you bought was already fraying. Having Old Navy be the “discount” Gap didn’t work well for Gap itself either. This year, both Gap and Banana Republic are still showing large losses. But Old Navy is pulling back: At its Gap North America division, same-store sales fell 12% for the quarter, at Banana Republic 13%, at Gap International, 4%, and at Old Navy -- the division that has been one of the worst performers of late -- the decline was just 3%. (In the same period a year ago, Old Navy's sales sank a steep 18%.)

Today if you walk into the store. there’s more actual basics being promoted – the tank tops, shorts, and flip flops that fit into a whole variety of fashion identities. One smart addition to the line are yoga -nspired exercise clothes. While fanatics of all sorts will still be decked out in brand names (LuluLemonistas we call them) , the Old Navy Athletica versions are versatile – a word I haven’t used to describe their clothes since they first opened.

This is not to suggest that the overall situation has changed – the Gap itself is losing ground, both because it’s a medium-end brand gaining a boost from celebrities wearing t-shirts to the Oscars (unless they can get Mrs. Obama to look beyond the J Crew catalogue). The consumer spending in that income bracket is getting more cagey, careful, and limited. That’s a trend that has to be considered durable, even if the recession lightens up. This is a message that’s most important for stores that depend on rapid growth, inexpensive and fast merchandise turnover, and single-category sales (clothing only versus Target, which can make up losses in one area with gains in another).

Posted by

Annie

at

12:44 PM

0

comments

![]()

Labels: brand identity, Old Navy, retail behavior

Sunday, May 24, 2009

Moms After Mother's Day: Getting Beyond the Surface from Color to Culture

Mother's Day is over, so that small spate of men and children shopping urgently is quietly over. Back to the basic rule of retail sales: women do the vast majority of shopping and purchasing, whether in real or web-based sites. That goes double for moms, who tend to manage the purchases for themselves, the household, and almost all the other family members. That means the mom is the gatekeeper for cleaning products, household furnishings, clothing, pet food and products, and even, surprisingly, electronics and outdoor living items. In this economy, more women may be struggling to stay employed, but interestingly they are also among the demographic groups most likely to return or start working outside the home or telecommuting. Not surprisingly, media technology and electronic resources have become even more significant in women’s lives.

Mother's Day is over, so that small spate of men and children shopping urgently is quietly over. Back to the basic rule of retail sales: women do the vast majority of shopping and purchasing, whether in real or web-based sites. That goes double for moms, who tend to manage the purchases for themselves, the household, and almost all the other family members. That means the mom is the gatekeeper for cleaning products, household furnishings, clothing, pet food and products, and even, surprisingly, electronics and outdoor living items. In this economy, more women may be struggling to stay employed, but interestingly they are also among the demographic groups most likely to return or start working outside the home or telecommuting. Not surprisingly, media technology and electronic resources have become even more significant in women’s lives.

“Power Moms,” as Nielsen Online calls them, are those who have young children and use electronic media for social networking, advice, shopping, consumer savings, and text messaging. Despite the wealth of information in Nielson’s report, most women – particularly women of color – feel that marketers ignore their needs. While there has been a decided uptick in the number of mainstream ads that feature African American families (for reasons so obvious, we need not mention them…), a vast majority of marketing campaigns have yet to really address the different needs and concerns of women of color. Consider how marketing campaigns target Asian or Hispanic women without consideration for the ethnic and regional differences collapsed by those categories. Or, more importantly, how these women might have something in common as consumers that goes beyond race. A simple note: the vast majority of Oprah Winfrey’s viewers are middle class white women, but her opinions and choices carry great sway among women consumers of color.

Taking account of women’s consumer habits is even more important in the current economic times. Here's one consulting firm's nine simple guidelines for marketing to women. However, despite better knowledge of segmented markets, marketing firms still seem decidedly slow to recognize that women’s retail behavior crosses similarities and differences in their outward status. For a good example, take a look at how marketers are stymied by racial differences in the social media landscape: BlogHer reported on this problem back in 2007, with a session infamously titled after one advertisers’s gaffe, “We don’t know what to do with you.” But according to Kim Moldofsky, a quick survey of women’s blog communities suggests that there is still a lack of outreach to women of color. Here’s a simple reminder: if the people in charge don’t look like their customers, chances are they’re going to have to work a bit to gain insights. This mirrors race relations in the non-digital world. Recent studies of racial attitudes and behaviors point to difficulties faced by whites who claim to want cross racial communities and friendships but find it exhausting trying to bridge cultural and social divides. While it’s clear that excuse doesn’t hold water for forging a more integrated society, it’s also a terrible limitation on marketing and sales.

One answer in the social media world is an upcoming Blogalicious Weekend in Atlanta in October, a conference designed to link blogging women of color to marketers, public relations consultants, and other advertising and brand-development executives.

Interestingly, in the M2M Neilson study, women of all races stated that they were most likely to take advice from others who had shared experiences and children in the same age bracket, two factors that were much more important than similarities in age, race, religion, or education. This suggests that marketers are really missing the boat when they presume that color determines cultural values and consumption. While it may be true in some cases, it seems clear that the complicated juggling act of motherhood and work is something many women share that can be experienced through online communities in ways that are, dare I say it, color blind? As Marketing to Moms CEO put it, “Moms share universal concern for their children, community and family…It is clear, however, that the way [women] react to the economy, rising food costs and the dreams she has for her children is impacted by her personal experiences, upbringing and ethnic background.”

Still, let’s not collapse all the differences: Although the majority of all moms have made household adjustments to cope with the family crisis, African American moms are more likely to delay major purchases to reduce shopping. Caucasian moms are using coupons and discount codes and driving less. Some of these differences are shaped by the fact that women of color are more likely to be in the workforce and are sometimes geographically concentrated in more urban areas where retail locations are scarce.

Women of all races were clear about the significance of the internet for their consumer purchases, there were some differences: When viewing advertisements, the majority of all respondents notice the product first, rather than the ad’s message. There was only a slight difference between white and black women in whether they always or frequently use a website before purchasing a product. The web is a gendered landscape, that's for certain, but marketing firms have barely begun to consider what that really means.

image of white and black barn owls from Daily Mail October 2008.

Posted by

Annie

at

11:10 PM

1 comments

![]()

Labels: Digital retailing, internet, mothers, race, segmented markets, women

Tuesday, May 12, 2009

The Internet and the economy force retailers to re-think the experience

It seems like some retailers are finally starting to realize that they can never win that way. Case in point:

The Brand Experience Labs notes Toys 'R' Us is pushing the retail concept further, though in a decidedly downmarket way: "Toys "R" Us is looking to give shoppers a reason to visit its stores more frequently with the rollout of the "R" Market store-within-a-store concept that provides a wide range of kid-focused products including diapers, infant formula, baby food, lunchbox items, paper goods, health and beauty items, household cleaners and more. Each "R" Market will feature roughly 1,300 items in a convenient shopping format located at the front of Toys "R" Us stores. The chain currently has "R" Markets in 260 stores with plans to roll the concept out to all of its 585 locations in the U.S. this year."

On the one hand, moving high-demand items to the front of the store may make it more likely that parents duck in for a quick purchase without having to commit to an hour of walking up and down aisles -- more if there are kids in tow. On the other, though, as BEL notes, taking the "grocery" approach might backfire for TRU, who have counted in the past on their image as the largest toy store chain to capture the imaginations of children and parents alike.

Likewise, Target just today announced that they too are trying out a new bricks-and-mortar retail approach that sounds surprisingly like Toys 'R' Us's. As Mediapost notes (via the WSJ), "Target is transforming a corner of a hundred of its discount department stores into mini-groceries stores that carry a narrow selection of products from 90% of the food categories found in a larger grocery store, Ann Zimmerman reports. It may eventually add mini-groceries to most of its 1,300 outlets as the key to its strategy to reverse declining sales." While grocery never faced the same threat online as dry goods and durables (with the brief exception the PeaPod experiment, which, a billion dollars later proved to be completely non-viable), Target and others have found it increasingly difficult to play the price game. As convenience has been something that people have consistently demonstrated their willingness to pay for, it seems like an obvious place for Target to focus on.

If companies like Target and TRU are experimenting with new ways to stand out from their competitors on- and offline (but especially on), it shouldn't be long before we start to see others do the same. After all, online-only retailers and Walmart can't wind up doing all the business, right?

Posted by

Bill Gerba

at

10:44 AM

1 comments

![]()

Wednesday, April 29, 2009

Coffee, Community, and Consumers in Complicated Times

As predicted, with the uncertain economic conditions and drooping retail sales, more and more marketing and business articles are focusing on the possible shift in consumer attitudes – the new frugality (simple is good), the suddenly cautious luxury market, and the joys of hanging out together at home. All of these “modes” are probably a reflection of some real behaviors and attitudes among Americans, but let’s take a look at one segment and consider whether these shifts really amount to something that marketing and development needs to consider today.

So, today, let’s start with coffee: before we were using the “r” word at all, there were some red flags signaling that Starbucks expected world domination was hitting its Waterloo. Dunkin Donuts and McDonalds were taking advantage of oversaturation and pricing issues to promote their own coffee, packaged in that perfect slot between “cheap” and "cool.” After all, Starbucks’ success was based on the experience of the space, the coffee, the brand, as much as it was about a really good cup of coffee. As price becomes more of an issue, customers can see the writing on the billboard (for in fact, McDonald’s has seriously steeped up its outdoor advertising to focus on the McLattes and other drinks that compete directly with Starbucks: the price wars campaign in December has moved toward showing the coffee itself in attractive photos).

If, for Starbucks, the brand focus shifts from ambiance towards value, it becomes a dangerous game of seesaw for a chain that is as much about the overall package as the item being sold. This is less so for McDs, which can make it up in other ways if this gamble fails – after all, they are a hamburger shop, despite the coffee, salad, healthy meals, you-name-it advertising. Unfortunately, for a coffee chain, it’s all about the coffee. Interestingly, the Washington Post reports that Starbucks is betting on major revenue from international sales of Via – that’s right: instant coffee (the ultimate downscale coffee beverage to most Americans).

If, for Starbucks, the brand focus shifts from ambiance towards value, it becomes a dangerous game of seesaw for a chain that is as much about the overall package as the item being sold. This is less so for McDs, which can make it up in other ways if this gamble fails – after all, they are a hamburger shop, despite the coffee, salad, healthy meals, you-name-it advertising. Unfortunately, for a coffee chain, it’s all about the coffee. Interestingly, the Washington Post reports that Starbucks is betting on major revenue from international sales of Via – that’s right: instant coffee (the ultimate downscale coffee beverage to most Americans).But let's compare: many areas report that local coffee shop sales are not down -- from State College PA to Pueblo NM, to Seattle (that’s right: Starbucks’ old home location!) local coffee shops seem to be doing okay (with the caveat that there are more stores closing or not doing well in areas that are generally hardest hit by unemployment and the housing slump). Part of the reason is that these shops do more than sell coffee – food accounts for a large percentage of their sales (something Starbucks is recently considering expanding) as well as ground or whole bean coffee to take home. Finally, the significance of social and communal interaction in a local place. Interestingly, the Seattle Times reports that people who’ve been downsized in corporate jobs are opening small businesses like coffee shops. Despite worries about regular sales (and that two year startup time where profits are nonexistent), the equipment and leasing costs are low right now, making it possible for some who might not have attempted this at another time to give it a go. Despite the ways in which Starbucks has become a McDonald’s-like symbol of the homogenization of culture, one thing that’s been well documented is the ways in which the coffee chain has actually spurred on the development of competing local businesses. Capitalism occasionally works the way it was intended.

What’s important to note here is that people’s spending habits are driven as much by social as economic needs. Consider how a coffee shop – whether it’s the Panera in the strip mall at the center of town, the Dunkin Donuts near campus, or the funky locally run place – actually does become Oldenburg’s “third place,” where those who have lost their jobs, are searching for new ones, or need a cheap place for a meeting for the price of a cup of coffee. These sites provide community, something that isn’t driven by budgetary considerations.

Ironically, in March, CEO Schultz announced that, rather than pulling back, they are expanding in Eastern Europe and China, along with 140 new stores in the US. This week, despite a community petition and phone calls from Oak Park activists, the corporate offices announced that it was closing the store (along with 400 others in the US) to “help its bottom line.”

Some would argue that it’s not good priorities to fight for a high-priced coffee shop in an area of town that boasts high rates of homelessness, unemployment, and few jobs: indeed, perhaps it’s not what the community and politicians should be doing with their time. But if Shultz is serious about making Starbucks an investment in local environments, the great good place rather than the only alternative, they might consider it a form of brand-building: a bit more consistency and goodwill in the overall policies would put the foam back in the latte.

Posted by

Annie

at

2:09 PM

1 comments

![]()

Labels: brand-building, coffee, community, local coffee shops, McDonald's, Starbucks

Tuesday, April 07, 2009

Niche Marketing: Tailoring the Goods as Well as the Pitch

Many of the posts on this blog have talked about segmented markets, core customers from specific demographics, and good marketing design that speaks to the right audience. Smart companies develop or streamline their products for the needs of that key group, often with good PR that travels over and beyond the dream demographic. But sometimes companies have to be pushed to recognize that they’re missing out on potential sales. Ten years ago the Wall Street Journal noted that some companies were beginning to notice that people with disabilities were an important market with some disposable income. According to Suzanne Robitaille, approximately 54 million adults-- one in five Americans -- have a physical or mental disability. She argues that “People with disabilities have a combined income of more than a trillion dollars -- and are willing to spend it on products and technologies that make their lives more productive…Brands that ignore the needs of this group relinquish an opportunity to reach this growing demographic.”

For a positive example, note the marketing news about Panasonic's Toughbook laptops which have "carved out a niche among people who use computers under the most trying circumstances -- think utility linemen, the military, construction workers -- but in this age of belt-tightening, marketing executives with the brand are thinking the brand's durability message may play to a wider audience." The success of designing and then selling to that specific market has encouraged Panasonic to create a multi-platform campaign of television, web-based, print, and out-of-home ads that considers how other users might also want a more resiliant laptop. The new campaign, which carries the theme "Toughbooks for a tough world,” is being promoted in airports and on shows like "CNN in the Morning" to capture the business traveler who might not realize the advantages of a more resilient product. In the same way that sportswear and hiking gear morphs into business and street wear, the "tested under extreme circumstances" approach entices users from a slightly different occupational group. Indeed, I suspect Panasonic has not yet exploited the full extent of its crossover from successful niche sales to larger markets. One of its Toughbooks is geared towards doctors -- another group that can appear authoritative or innovative to "regular" consumers. Toughbook provides the "first fully-rugged mobile clinical assistant (MCA), will be one of its many mobile healthcare solutions innovative engineering, resulting from its own proprietary global healthcare industry research and Intel’s mobile clinical assistant (MCA) reference design. The device improves workflow and eases clinical loads for doctors and nurses, helping healthcare organizations maximize efficiency and reduce errors... [It] is a secure and intuitive platform for barcode medication administration (BCMA), vitals capture and electronic medical records (EMR) capture and review." Given the popularity of hospital-based on television, philanthropic work in the field by Doctors without Borders, and concerns about emergency medical response in disasters, Panasonic might also consider how to promote its product even more.

Posted by

Annie

at

11:36 PM

3

comments

![]()

Labels: apple, disabilities, technology, Toughbooks

Thursday, April 02, 2009

Change is not always good

Orange juice giant Tropicana has recently been taking some flack for redesigning the packaging on what was, essentially, already a successfully functioning brand and look. Pepsico, its parent company, recently announced that after less than two months of the new design, it will return to its original packaging due to customer complaints. Consumers said that the new look (which replaces the now iconic orange with a straw for a more abstracted glass of juice) made Tropicana blend in with generic brands on the shelf and presented problems when hurried shoppers tried to distinguish between the varieties such as “no pulp,” and “extra calcium.” At a time when private label brands are surging and an item already has a strong brand image and core customer base, this definitely wasn’t a great move (especially when the volume of complaints was not that huge, but they were from people who labeled themselves as long time brand users).

Orange juice giant Tropicana has recently been taking some flack for redesigning the packaging on what was, essentially, already a successfully functioning brand and look. Pepsico, its parent company, recently announced that after less than two months of the new design, it will return to its original packaging due to customer complaints. Consumers said that the new look (which replaces the now iconic orange with a straw for a more abstracted glass of juice) made Tropicana blend in with generic brands on the shelf and presented problems when hurried shoppers tried to distinguish between the varieties such as “no pulp,” and “extra calcium.” At a time when private label brands are surging and an item already has a strong brand image and core customer base, this definitely wasn’t a great move (especially when the volume of complaints was not that huge, but they were from people who labeled themselves as long time brand users).

Interestingly, the actual packaging differences are not enormous: the color scheme, the single color item emphasis, and the logo offer some carry-over from the original design.

But perhaps the marketing folks at Pepsico misunderstood the power of its original design in relation to the place Tropicana holds in its customers’ brand memory. You would think they’d have learned their lesson with the recent trouncing of its parent company for re-vamping the Pepsi logo to be more in sync with the Obama “O” and piggybacked off of its message of hope and, well, change. While the change brought media attention to the brand, it wasn’t the kind that marketers had in mind. Another recent change that’s also been universally disliked by users is the new Facebook interface. While logo changes are mostly for cosmetic and visual appeal, the complaints about the new Facebook, while not reducing its phenomenal growth in any way, means that users will have to adapt in more interactive ways. Interestingly enough, the petition against the new Facebook, signed by almost two million people, is of course, hosted on the Facebook site itself. The COO of the company talked about the interface as an evolving platform, always in the works and that they are interested in taking users’ concerns into consideration with each new iteration. While not a perfect incorporation of consumer feedback, it’s probably the right tack to the take for this kind of product.

Another recent change that’s also been universally disliked by users is the new Facebook interface. While logo changes are mostly for cosmetic and visual appeal, the complaints about the new Facebook, while not reducing its phenomenal growth in any way, means that users will have to adapt in more interactive ways. Interestingly enough, the petition against the new Facebook, signed by almost two million people, is of course, hosted on the Facebook site itself. The COO of the company talked about the interface as an evolving platform, always in the works and that they are interested in taking users’ concerns into consideration with each new iteration. While not a perfect incorporation of consumer feedback, it’s probably the right tack to the take for this kind of product.

Some manufacturers have gone one step further and gotten customers more deeply involved in the actual package design process. Stoneyfield Farms redesigned its yogurt packaging and logo--- although they’ve already finished getting input and made a choice based on it, still asking its online community to rate the various choices. Their online poll is a bit stilted, but it has the nice feature of allowing survey respondents to invent their own answers and then have those answers integrated into future version of the survey. Not only does this give the brand more of a transparent image with its core customers, it fits with the overall presentation of the company as engaging a larger community of consumers who buy Stoneyfield as part of a commitment to a particular lifestyle and set of values. Perhaps if Pepsico had paid more attention to those kinds of sociometrics, the desire for change would not have hit them quite so hard.

Posted by

Annie

at

7:15 AM

0

comments

![]()

Monday, March 30, 2009

Candy is Dandy

What sells? That is the bottom line in retail, but it’s also a huge question in turbulent times. While President Obama’s economic advisors work hard to convince the public, investors, and the world that we will return to productivity and consumption, even they can’t completely answer the question of what products, services, or goods will be the key items in the new, post-fiscal-traumatic-stress market. But here’s a pretty interesting answer:

What sells? That is the bottom line in retail, but it’s also a huge question in turbulent times. While President Obama’s economic advisors work hard to convince the public, investors, and the world that we will return to productivity and consumption, even they can’t completely answer the question of what products, services, or goods will be the key items in the new, post-fiscal-traumatic-stress market. But here’s a pretty interesting answer:

Candy.

But despite the hype about drastic and dramatic change, some aspects of recovery are necessarily conservative. And what’s more conservative than comfort foods? The recent surge in candy sales (The Times reports an 80% increase since last year in one major Chicago candy store) can be seen as a sign that folks are anxious, eating what makes them feel better in anxious times. Candy is always a good bet -- especially on what seems like a bad day that keeps repeating -- notwithstanding the things I'm sure my nutrition-savvy friends will say about sugary sweets adding to hyperactivity rather than calmness, but hey, that’s background noise.

The cultural history of sugar is as both luxury and necessity. The great anthropologist and author of Sweetness and Power, Sidney Mintz, points out that by the 1500s, sugar production was already pre-industrial in the New World, which generated a whole host of other industries, including the tools and gears, molds, and iron casts used to refine the substance and food production (think: canning). Within the next 200 years, Europeans colonized the Caribbean, imported slave labor from Africa (after wiping out much of the indigenous population), and produced sugar in large quantities that could be shipped back to be consumed by the working populations who were fueling the industrial revolution on that side of the Atlantic. As Mintz points out, what was once a luxury item soon became a necessity for survival (most workers subsisting on sweetened hot tea or jam and bread, foods that provided energy for long days of factory labor). But sugar retains its connection to luxury, with its use in desserts and confections. Nobility were no longer the only ones to have their cake and eat it too.

In terms of today’s sweet tooth, candy may be a quick pick-me-up for difficult times, an indulgence and a necessity that most people feel they can still afford.

And finally, there’s that whole pantheon of choices. American consumers have been deeply indoctrinated in the value of choice. When asked what makes someone or some thing American, my students almost invariably answer, “we can choose what we want to do, how we live, and what we eat.” Food marketers in particular have had to hone the message of variety – a type of Oreo cookie for every mood, every personality, and every season – in order to keep selling when it’s possible to have fed the world three times over with the excesses that generally flood our marketplace. Having wholeheartedly taken that message in, the shift in attitude can be a little rough for some consumers: yes, people are suddenly saving more, making frugality sexy, and adapting to the green “less is more” mantra. But does it mean they have to give up variety everywhere? The endless pleasures of a fertile marketplace? An inexpensive and satisfying treat? Not in the candy aisle! The last ten years have seen an explosion of types of new candy and re-introductions of old favorites. The candy section in many supermarkets is the last refuge of those 70s co-op bulk bins, no longer filled with dry lentils and granola, but colorfully bursting to the brim with Smarties, Mary Janes, Starbursts, and Jelly Beans.

But as for Hershey’s saving the economy, don’t bet the last of your nest egg just yet. Questions about its stock value, mergers, and steady sales after the last of the big candy holidays (Easter) suggest that you might be better off buying a few bars to sooth the soul and waiting to see if demand is more than just a recessionary sweet tooth.

But as for Hershey’s saving the economy, don’t bet the last of your nest egg just yet. Questions about its stock value, mergers, and steady sales after the last of the big candy holidays (Easter) suggest that you might be better off buying a few bars to sooth the soul and waiting to see if demand is more than just a recessionary sweet tooth.

Posted by

Annie

at

7:06 AM

0

comments

![]()

Subscribe to this blog

Subscribe to this blog